Making Tax Digital for Income Tax

HMRC has at last published regulations for the record-keeping requirements for Making Tax Digital for Income Tax Self Assessment. What’s the full story?

Starting in 2023/24, if you receive income greater than £10,000 per year from self-employment or rental income from land or buildings you’ll be required to make quarterly online reports of your business/rental income and outgoings, plus an annual summary.

The first MTD ITSA report will therefore be for the quarter ended 5 July 2024, however you must have digital record keeping systems in place earlier.

The update information that must be provided in a quarterly update is dependent on the relevant person’s business or businesses.

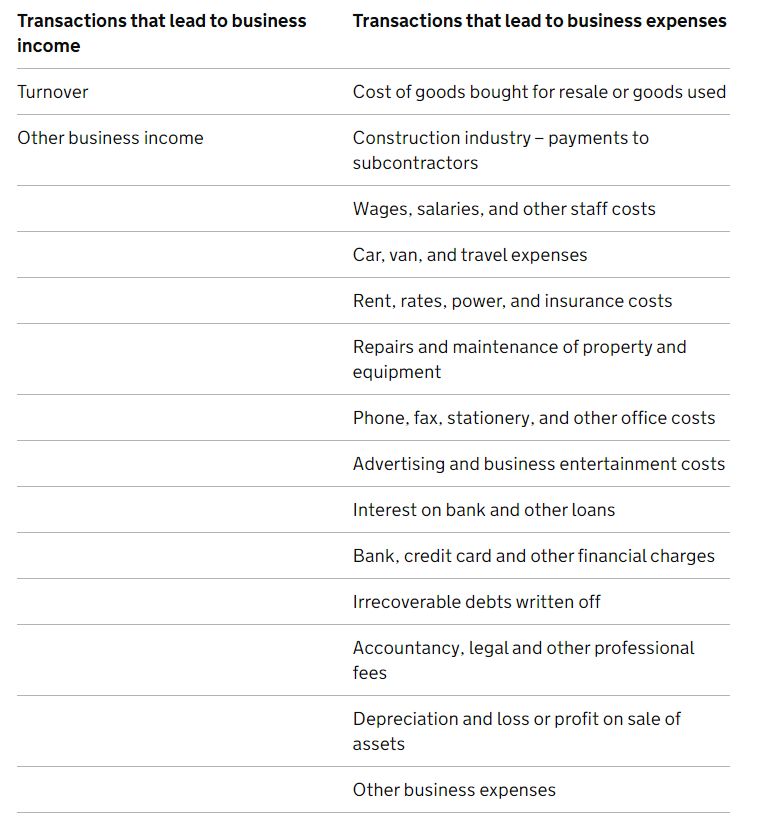

Businesses with trade profits:

A relevant person with trading income must provide the following update information in each quarterly update:

- quarterly period start date

- quarterly period end date

- totals of the amounts falling within the categories of transactions set out in the following table:

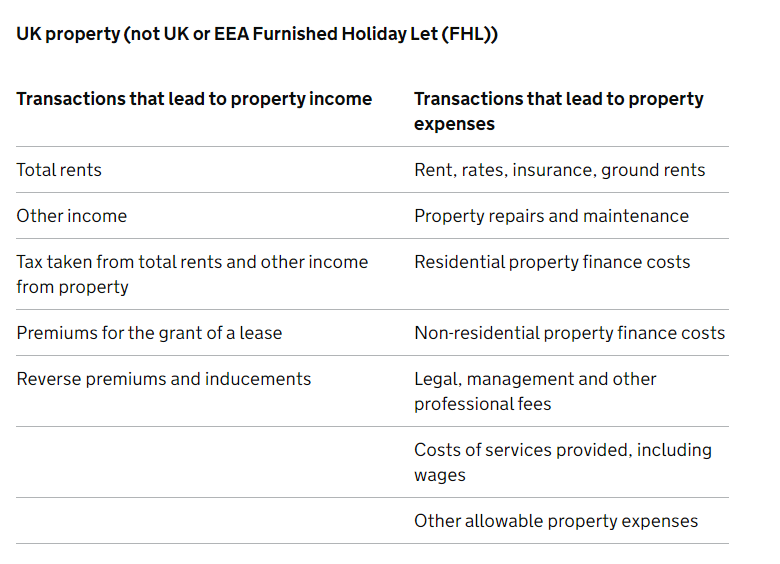

Businesses with property income:

A relevant person with property income must provide the following update information in each quarterly update:

- quarterly period start date

- quarterly period end date

- totals of the amounts falling within the categories of transactions set out in the following table:

Software. MTD ITSA means you’ll either have to use HMRC-approved software to keep your day-to-day business/rental income and expenses records or use a spreadsheet plus so-called bridging software to collate the data and make MTD reports to HMRC. HMRC’s draft regulations published on 1 July 2022 set out the format and type of information required.

Your reports must summarise income and outgoings from your records into the categories currently used for your annual self-assessment tax return. One difference is that you won’t be required to make adjustments for non-tax deductible items on the quarterly reports.

These will be required on the annual summary report only. Retail businesses will be able to make a special election to exclude certain information from their reports, such as erroneously recorded sales.

Tip. Reporting will be more straightforward if you choose to use HMRC- approved software as the income and expenses categories will already be set up. If you use bridging software you’ll need to digitally link your records to fit the software.